Kannan R Nair, Research Intern, ICS

Recent skirmishes between China and India at Galwan Valley ignited debates in policy circles across New Delhi about growing importance of Taiwan in positioning India’s stance towards Beijing. Currently, Taiwan is India’s 35th largest trading partner, and for Taiwan, India is 17th largest trading partner. In 2019-20, trade accounted for US$ 5.7 billion, which is a decline of 17.54% as compared to the previous year. However, in the current strategic context, India’s appointment of seasoned diplomat Gauranglal Das as an envoy to Taiwan and virtual participation of two parliamentarians in Taiwan president Tsai Ing-Wen’s swearing-in ceremony indicates a shift in policy towards China.

Since the 1990s, there have been efforts to diversify Taiwan’s trade beyond mainland China. In 1994, Taiwan president Lee Teng-hui officially announced the ‘Go South Policy’ aimed to improve its trade and investment relations with ASEAN countries. India was also included in the policies owing to its growing economic importance after the DPP (Democratic Progressive Party) won the presidential election for the first time under the leadership of Chen Shui-Bian in 2000. The DPP government signed a Bilateral Investment Agreement (BIA) with India in 2002, which came into force in 2005. The agreement stressed on the need for protection and promotion of investments.

In 2011, China Steel Corporation (CSC), the largest integrated steel maker in Taiwan invested $178 million in Bharuch district of Gujarat. A rapport existed between the Indian state of Gujarat and its then Chief Minister Narendra Modi with Taiwanese firms. Informal deliberations for a FTA (Free Trade Agreement) between Taiwan and India were held when he later became Prime Minister of India in 2014, the discussions for which are ongoing and not finalized and. India also signed a Double Taxation Avoidance Agreement (DTAA) and a Customs Cooperation Agreement with Taiwan in 2011. The BIA was updated by both of the countries in 2018 to ensure that Taiwanese businessmen’s investments are treated in synchrony with international standards. The COVID-19 spread raises generous challenges and opportunities to furthering India-Taiwan relations together.

Opportunities

China is Taiwan’s largest trading partner accounting for 30% of total trade. Tsai Ing-wen’s reelection exhibits the changing perception in Taiwanese people against Mainland China. According to a survey conducted by the Pew Research Center in 2019 among Taiwanese youth shows that about 85% of the participants supported close economic relations with the United States, at the same time, support for Beijing was limited to 52%. The New Southbound Policy (NSP) initiated in 2016, reoriented the prime focus of Taiwanese firms from China. Apart from NSP, there are several reasons substantiating the migration of firms from Mainland China. First, increasing intense competition from Mainland companies in the manufacturing sector. This adduced as the primary reason for the firms shifting their business to huge markets with similar traits. Second, rising labour costs and lastly the instability in markets caused by the US-China trade war.

According to Sana Hashmi, a Taiwan Fellow at the Institute of International Relations, National Chengchi University in Taipei, there was a dip in the trade figure last year. More than trade, Taiwanese companies see India as a vast market for investment. Foxconn is already investing US$ 1 billion in the Apple plant at Chennai. Therefore, the focus should be on attracting investment in the post COVID-19 period.

Keeping the market potential aside, the cheap labour cost in India, as compared to PRC, invited more attention. Soon after Foxconn’s announcement regarding their $1 billion investment to set up a factory in India, Pegatron, the second-largest assembler of Apple iPhones based in Taipei announced their interest to set up a plant in India. The availability of skilled labour, massive mobile user base and Indian government’s policy initiatives like Make in India and by latest ‘Atma Nirbhar Bharat’ has attracted foreign investments from Taiwan.

During the pandemic, China’s expansionism yielded more investments to India from Taiwan. Policymakers should endorse the role of Taiwan in addressing India’s technology deficits. Under the aegis of Make in India and Atma Nirbhar Bharat, India should work towards attracting more investment which will have an impact on the rising unemployment rates. As Taiwanese exports to India majorly concentrated on heavy machinery and engineering tools, India must make use of the current geopolitical/geoeconomic environment by inviting more firms.

Challenges

The first challenge is regarding the long-standing talks on FTA between India and Taiwan. To address this, both sides need to fast track talks and finalize an agreement by sidelining political difficulties. A two-year joint feasibility study was conducted by the Indian Council for Research on International Economic Relations and Chung Hua Institution for Economic Research in Taiwan during the 2011-13 period. The study suggested an Economic Cooperation Agreement (ECA) for promoting trade relations. As stated by Taiwanese officials, India and Taiwan are also in the negotiations regarding allowing Special Economic Zones (SEZs) for Taiwanese firms. Currently, India has SEZs with Chinese and Japanese firms.

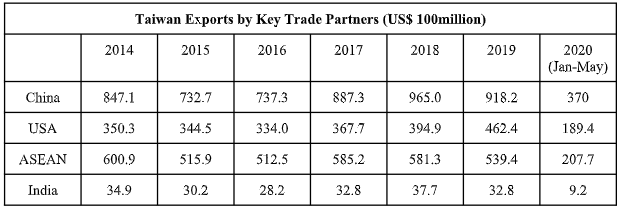

Source: Taiwan Ministry of Economic Affairs

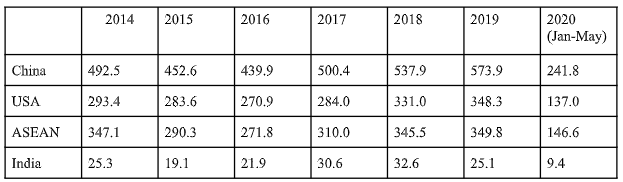

The trade figures also affirm the fact that India is way back in terms of trade, as compared to other dominant countries. Here a contradiction in China’s actions is it’s exponential growth in trade with Taipei on one hand and restricting India to do the same on the other hand.

Source: Taiwan Ministry of Economic Affairs

The second challenge is regarding the unbalanced tax system. Recently Taiwan and Japan approached the World Trade Organisation (WTO) to set up dispute settlement panels against India owing to lopsided tariff structures on Information and Communication Technology (ICT) devices and mobile phones imported from them. Imbalance in this tariff structure restricts the prospective inflow of investments towards India.

Transparency in the legal system and effective utilization of decentralized governance can also trigger foreign direct investments. Open-ended support from local governments to a business-friendly environment can also help in this regard.

India and Taiwan share many commonalities such as belief in democratic values and similar economic potentials. In the current geopolitical scenario, India’s best option would be to enhance trade and people to people interactions with Taiwan. Both are gradually strengthening their bilateral ties. Tapping into Taiwan’s Taiwan’s expertise in healthcare, education and agriculture would help India in the future.