Karthik Satheesh, Research Intern, ICS

Since the late 1970s, China had started to shift from a centrally-planned system towards a market-oriented economy. One of the most notable features of the post-1980s China’s economic development was its increasing participation in international trade. Chinese exports rose on average 5.7% in the 1980s, 12.4% in the 1990s, and 20.3% between 2000 and 2003. By 2003, China’s export growth rate was seven times higher than the export growth rate recorded by the world as a whole. By 2006, the year when China recorded the highest trade (exports and imports), trade constituted 64% of China’s GDP.

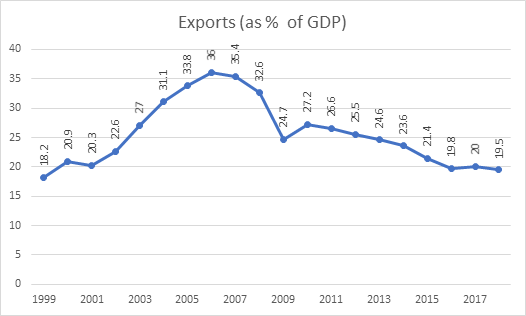

Many countries have followed the export-led path to growth in the past and have achieved rapid growth in GDP. However, the threat of facing a global demand crunch always looms large for these economies. During 2008-09 (global financial crisis) period, China faced the same situation- its export as a percentage to GDP (see graph below) fell to 24% in 2009 (as opposed to 36 % in 2006) and its GDP growth rate fell from 14% in 2007 to 9% in 2008. This is indicative of the fact that exports were imperative to China’s growth, and when faced with a global demand slump it fumbled. Even though China managed to have a relatively high growth rate in that period, such a situation is a nightmare to an export-led economy.

Since then there has been a steady decline in exports’ percentage in GDP for China. In 2018, this figure stood close to 19%- similar to that of countries like Egypt and Uganda. Meanwhile, GDP growth more than halved during this period from 14% to around 6% growth rate (in 2019).

Source: World Bank

The steady decline in exports and imports points to the fact that China is gradually reducing its dependence on exports. This can be further coloured by the fact that both exports’ and imports’ share in GDP have fallen massively, in this decade. This means that the consumers in China have been absorbing what otherwise would have been exported and as private demands are increasingly being met domestically the imports have also slumped (from 28% in 2006 to 18% in 2018).

China now seems to be focussing on boosting domestic consumption after decades of export-led growth strategy. According to the Economist Intelligence Unit, private consumption will soon constitute nearly half of China’s GDP. But is such a shift possible and if so, how? These are a few factors that have significantly boosted domestic consumption:

- China’s per-capita income has more than doubled in the last decade thanks to its rapid growth. This means that an average Chinese have more than double the means to consume than he had a decade ago.

- Another factor is the high adaptability and competitiveness of the Chinese retail market which ensures that home-grown retailers are always on the front line to extend goods and services to the booming consumer demand. Chinese retail market has shown extreme resilience and creativity and for the same reason, it is soon expected to emerge as the largest retail market in the world, surpassing the US.

- Additionally, the fast-moving consumer goods market has shown excellent growth with around 4.3% growth rate in 2017 and it is expected to account for more than half of the whole economy by 2030 according to the Economist Intelligence Unit.

- Consumer behaviour in China has been changing from conservative high savers to potential spenders. This fact is highlighted by tourism spending in the year 2018: Chinese tourists spent around $277 Billion which accounts to nearly 18% of global tourism spending which is higher than any other country.

- Moreover, as of 2018, nearly 60% of China’s population lived in cities which indicated a high rate of urbanisation (urban population growth is around 2.4% annually). This bridges the gap between the middle-class buyers and the booming retail market in the country, which in turn helps in boosting private consumption.

All these aspects, combinedly, have bolstered the shift of Chinese economy’s dependence towards domestic consumption.

A similar trend could be seen in the shift from an industry-based economy to a service-based economy; in 2006 industry contributed 13% more to China’s GDP than services while in 2016 it was the other way round. A service-based economy is a salient feature of most of the developed countries.

If we observe these trends, China seemed to have been making a steady transition from an export-led industry-oriented economy to a domestic-consumption-led service-oriented economy. However, the novel Coronavirus pandemic has left its economy hanging in uncertainty. According to World Economic Outlook, China’s growth rate is expected to shrink by more than 5% this year; the GDP growth rate is expected to be 1.2% in the year 2020 while this figure was 6.1% in 2019. The great lockdown has affected the Chinese economy very much- retail market, tourism, export declining due to global demand crunch- all of which will have a negative influence on the economy. Although nations around the world are foreseeing a recovery as soon as possible, experts do not expect this to be a v-shaped recovery. The recovery period might give China, which has already lifted lockdown restrictions, an incentive to focus more on its domestic consumption and strengthening its retail market. Even though exports in China has bounced back significantly higher than expected in the month of April (though it has and will remain quite low because of the existence of lockdown in many of China’s partner countries), domestic demand appears to be resilient and increasing– a trend we have been witnessing even prior to the lockdown.

Global merchandise trade is expected to decline 13-32% due to COVID-19 and the WTO has commented that the decline in world trade due to this pandemic will likely exceed the one accompanied by the global financial crisis of 2008-09. The post-pandemic period most likely will witness an accelerating trend of declining dependence on export-led growth for China for various reasons:

- Deglobalisation: Even before the pandemic struck, deglobalisation was increasingly spreading around the globe, fuelled by the Sino-US trade war and the financial crisis. The pandemic has further instilled a feeling of self-reliance and accelerated this phenomenon- politicising travel and migration, cross accusations and exposure of anarchy in global governance in the recent crisis has contributed to the promotion of deglobalisation.

- Global Value Chain (GVC) under pressure: By becoming a hub for cheap and efficient manufacturing, China was an integral part of the supply and value chain of many goods. However, after the COVID crisis, major economic players are planning to shift their manufacturing and production facilities back to their own countries, away from China, foregoing the manufacturing efficiency and cost minimisation that globalisation has offered them in the past. This increasing pressure on GVCs means that China’s exports and manufacture sector will be affected in the coming years.

- Lockdown in partner countries: During the height of the coronavirus outbreak in China (January-February period) exports plummeted 17.2% and in April there was a surprising 3.5% jump in exports. However, even though China came out of lockdown successfully its trade partners are still in lockdown and fighting the virus. Hence, global demand is expected to remain low for the months that follow.

- Trade war: Even before the pandemic, the US-China trade war shook China’s trade with its largest trade partner, US. A small relief in the trade war came in January, in the “phase-one” deal, when both sides agreed to give concessions on heavy tariffs imposed before. Recently, the cross accusations and mutual blame have further threatened the progress that lies ahead of “phase-one” negotiations and could even aggravate the problem further. A trade-war at this point will be heavy on China’s side and will affect its trade drastically.

- Direct interventions: The Chinese government has adopted policies to boost domestic consumption in the country to mitigate the heavy losses in exports that accompanies the slump in global demand. These policies are aimed at brand promotion of Chinese owned brands and on the same hand reducing the market for imported goods. Additionally, there are efforts to establish domestic duty-free shops, encourage domestic tourism and also to attract foreign tourists which could boost domestic demand and result in increased domestic consumption.

The COVID crisis could accelerate the Chinese economy’s dependence on domestic-consumption, owing to the various factors discussed above, that are currently at play. Therefore, the trend that we can expect is a “reducing dependence” on exports in the coming years and an increasing dependence on domestic consumption, accelerated by the COVID-19 pandemic.