People > Santosh Pai

Santosh Pai, has been offering legal services to clients in the India-China corridor since 2010. His areas of interest include Chinese investments in India, India-China comparative law and policy, cross-cultural negotiations and board governance. He holds a B.A., LL.B. (Hons.) degree from NLSIU, Bangalore, LL.M. (Chinese law) from Tsinghua University, Beijing and an MBA from Vlerick University, Belgium (Peking University campus). His manuscript "Practical Guide on Investing in India for Chinese investors" has been translated into Chinese and published by China Law Press. Santosh is currently a partner at Link Legal, an Indian law firm. He is a member of CII's Core Group on China, teaches two courses on India-China business at IIM Shillong and volunteers at NGOs in his free time.

Santosh Pai joins In Focus by The Hindu to talk about the impact of the Press Note 3, the increasing trade deficit between the two countries and how India can best use the “China+1” policy to its advantage.

India and China first set themselves the target of $100 billion for bilateral trade in 2010 when trade volume stood at $60 billion

In April last year, border tensions between India and China escalated after the two sides accused each other of violating the Line of Actual Control

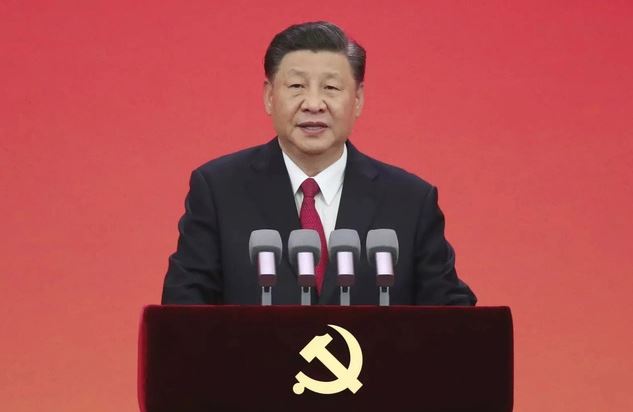

We are all too familiar with how power is claimed and retained in a multi-party democracy. But how does one retain power and legitimacy in a single-party system

In this episode, we are looking at the battle unfolding in China between its big tech companies and Communist Party regulators in the wake

There are vast dissimilarities between the design and performance of FDI policies in India and China. While China witnessed consistent growth in FDI inflows since 1978, a post-COVID19 downtrend is expected due to a desire for diversification in global value chains.

How is legal tender issued by the central bank different from payments guaranteed by a third-party operator?

In this episode, we look at China's plans for a Digital Currency, officially titled the Digital Currency Electronic Payment (DCEP), also known as the digital RMB (the Renminbi is China’s currency).

China’s urge to dictate the fortunes of its technology giants is coinciding with a global backlash which is pushing them to seek listings closer to home.

Reducing dependency on imports from China has emerged as a national policy objective for India in 2020. This paper presents a framework that can support decision making in this direction and some techniques to monitor India’s progress in this journey.

Instead of focusing on beneficial ownership, India can insist on residents retaining control

China offers an exceptional model to demonstrate how FDI can be attracted and retained. India can learn from them, writes Santosh Pai of Institute of Chinese Studies.

Can India Bear 'China Boycott' Call?: Experts On India Today Share Insights

Will Buying Only India-Made Goods Really Save The Indian Economy?

The Narendra Modi-led government at the Centre revised India's foreign direct investment policy to curb “opportunistic takeovers or acquisition” of Indian companies due to the COVID-19 pandemic on April 18, 2020.

Masking in glory: An incremental purchase of shares in HDFC by the People’s Bank of China made news, recently. reuters

The impact of Covid-19 on each country’s economy is a complex function of numerous factors. Relevant factors include extent of disruption caused by lockdown, financial health of enterprises and pattern of industrialisation. The response of each national government is a function of its financial strength, type of political

The Foreign Investment Law (FIL) was the most significant legislation approved by China’s National People’s Congress in its March 2019 session. It repeals three existing laws that have served as pillars of the FDI regime for almost four decades

Chinese investments in India, India-China comparative law and policy, cross-cultural negotiations and board governance

Honorary Fellow

Partner at Link Legal

B.A., LL.B. (Hons.) degree from NLSIU, Bangalore,

LL.M. (Chinese law) from Tsinghua University, Beijing and

MBA from Vlerick University, Belgium (Peking University campus)

© 2019 ICS All rights reserved.

Powered by Matrix Nodes